mass tax connect make estimated payment

Business and fiduciary taxpayers must log in to make estimated extension or return. Open link httpsmtcdorstatemausmtc_ From this page click on the.

Purchase Price Allocation Ppa Deloitte Netherlands

Individuals including sole proprietors partners and S corporation shareholders generally have to make estimated tax payments if they expect to owe tax of 1000 or more when their return is.

. Paying electronically is fast easy and secure. Electronic Payment Options Make your estimated tax payments online at massgovmasstax-connect and get immediate confirmation. Your support ID is.

This marginal tax rate. Form 1-ES is a Massachusetts Individual Income Tax form. Fiduciary tax payments can also be made on the website but an account with log in information is needed.

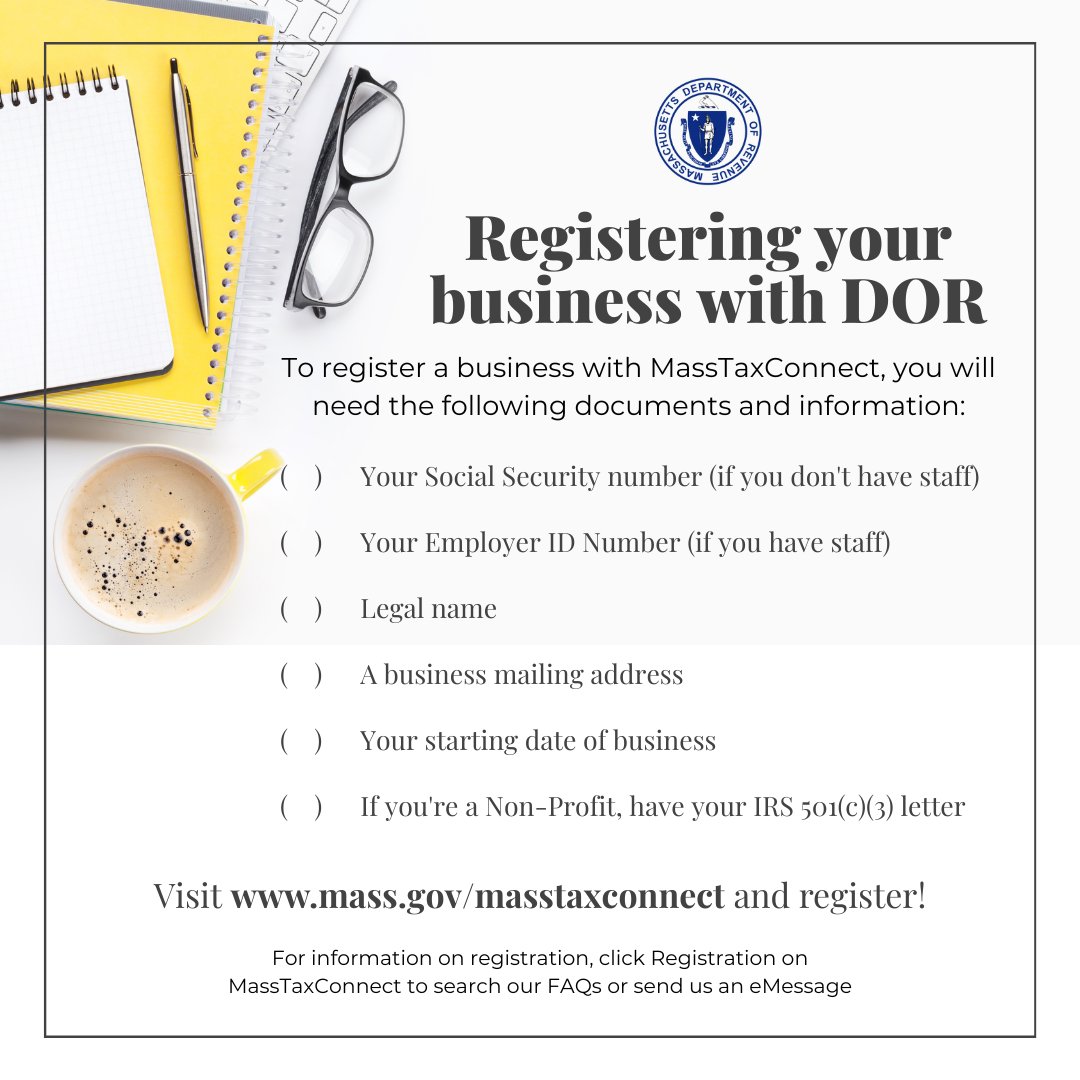

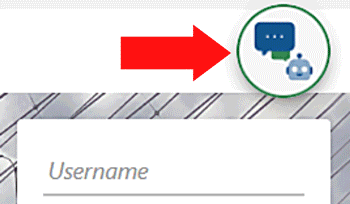

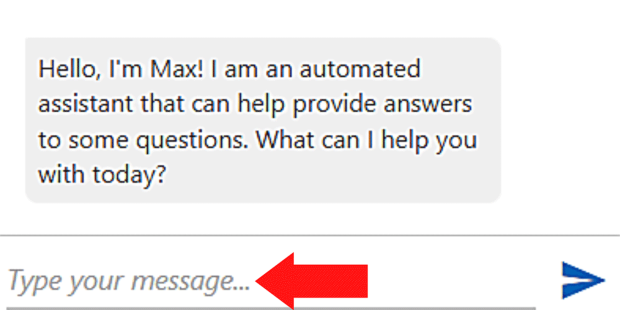

Please enable JavaScript to view the page content. Welcome to MassTaxConnect the Massachusetts Department of Revenues web-based application for filing and paying taxes in the Commonwealth. ONLINE MASS DOR TAX PAYMENT PROCESS.

Mass tax connect make estimated payment. Please enable JavaScript to view the page content. Business taxpayers can make bill payments on MassTaxConnect without logging in.

800 392-6089 toll-free in Massachusetts You may also connect with DOR with MassTaxConnect by email or in person. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money. Make a Payment with.

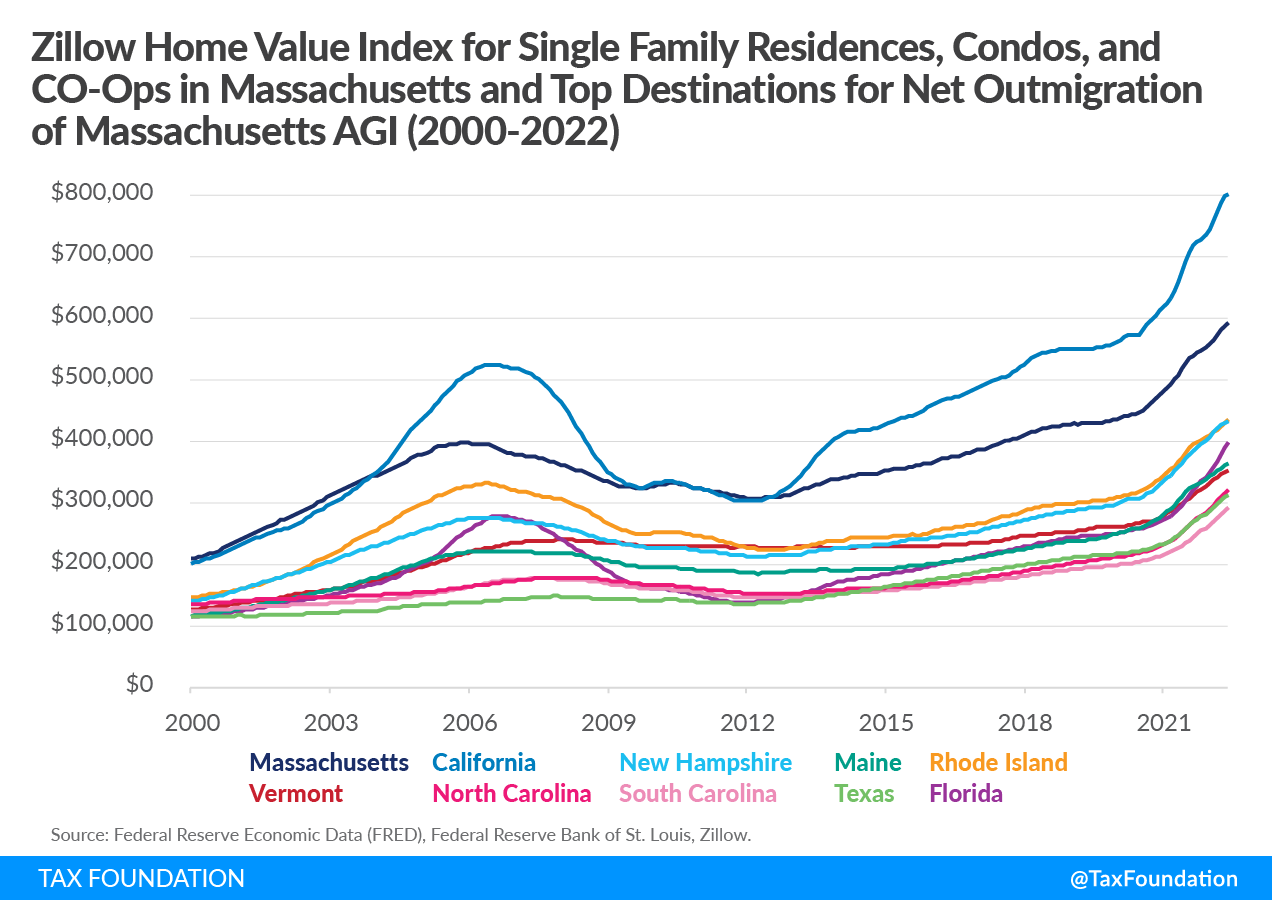

Your support ID is. Check Your Refund with MassTaxConnect. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

Your average tax rate is 1198 and your marginal tax rate is 22. Under Quick Links select Make a payment in yellow. Use this link to log into Mass Department of Revenues site.

You can make payments for your liability before billing but the notice of intent must be issued before determining the terms of the plan. Business taxpayers can make bill. Select individual for making personal income tax payments or quarterly estimated income tax payments.

Advance Payment Requirements Mass Gov

Tax Guide For Pass Through Entities Mass Gov

Pin On Bentley Lifetime Happiness

Massachusetts Sales Tax Guide And Calculator 2022 Taxjar

Massachusetts Dept Of Revenue Massrevenue Twitter

Massachusetts Dept Of Revenue Massrevenue Twitter

Masstaxconnect Resources Mass Gov

/operatingmargin2-0ea7e3aeb5e5473bb2f5a174217c4396.png)

Operating Margin What It Is And The Formula For Calculating It With Examples

Masstaxconnect Resources Mass Gov

2021 Personal Income And Corporate Excise Tax Law Changes Mass Gov

Tax Free Weekend August 13 14 2022 Mass Gov

Massachusetts Income Tax H R Block